California’s home insurance market is facing a severe crisis as more insurers are pulling out of the state due to the increasing risk and cost of wildfires. Homeowners are struggling to find affordable and adequate coverage, while some are forced to rely on the state’s insurer of last resort.

Insurers Exit the Market

According to a report by Action News Now, two more insurance companies, AmGUARD and Falls Lake Fire & Casualty, have announced their plans to withdraw from California’s home insurance market. AmGUARD will stop writing personal line policies in the state effective August 21, 2023, while Falls Lake will exit the market on September 21, 2023. Both companies cited the high exposure to wildfire losses and the difficulty of obtaining reinsurance as the main reasons for their decision.

These two companies are not the only ones that have decided to leave California’s home insurance sector. Earlier this year, State Farm, Allstate and Farmers Insurance also announced that they would stop writing new home policies in the state. Liberty Mutual also pulled its business owner policy line from the state starting this fall. These moves have left many homeowners with fewer options and higher premiums.

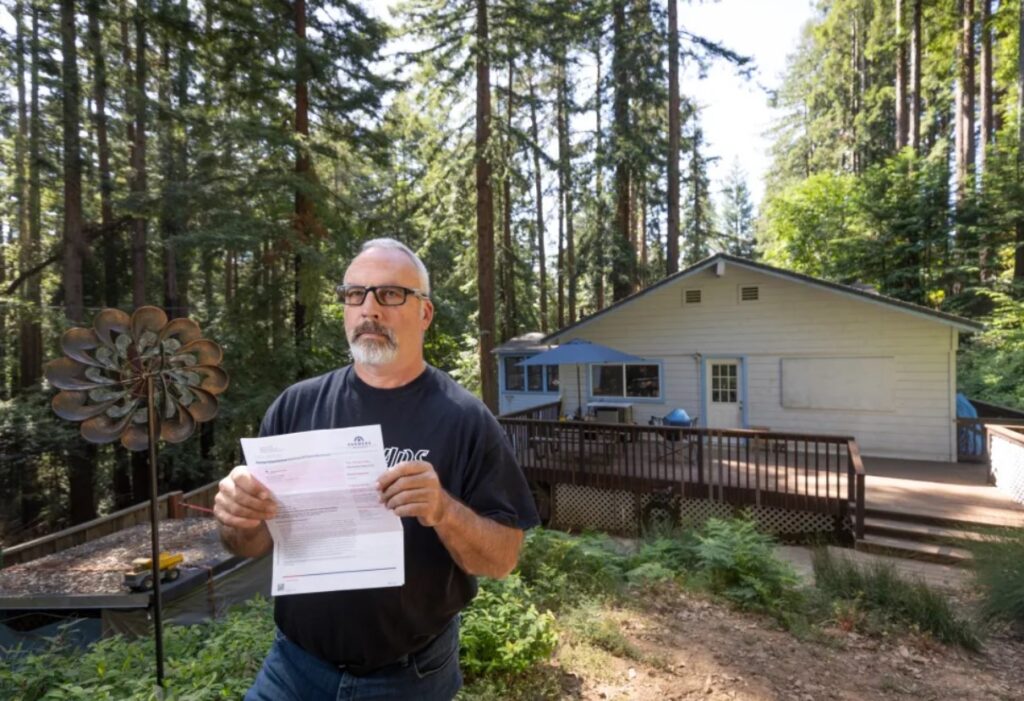

Homeowners Face Hardship

The exit of insurers from California’s home insurance market has created a hardship for homeowners who are trying to protect their properties from wildfires. Many homeowners have seen their policies canceled, non-renewed or surcharged by their insurers. Some have been unable to find a new insurer willing to cover their homes at a reasonable price. Others have been forced to accept policies with lower coverage limits, higher deductibles or exclusions for wildfire damage.

Some homeowners have resorted to the California FAIR Plan, which is the state’s insurer of last resort for high-risk properties. The FAIR Plan offers basic fire insurance coverage, but it does not cover other perils such as theft, liability or water damage. Homeowners who opt for the FAIR Plan also have to purchase a separate policy, called a difference in conditions policy, to cover the gaps in coverage. However, these policies are also expensive and hard to find.

Solutions Sought

The California Department of Insurance (CDI) has been trying to address the home insurance crisis by encouraging insurers to offer more incentives for homeowners who take steps to mitigate their wildfire risk. The CDI has also been working with legislators and stakeholders to find long-term solutions that would balance the needs of homeowners and insurers.

One of the proposed solutions is Senate Bill 11, which would create a statewide wildfire risk pool that would provide reinsurance for insurers who write home policies in high-risk areas. The bill would also require insurers to offer discounts for homeowners who implement fire-hardening measures on their properties. The bill is currently pending in the legislature.

Another proposed solution is Assembly Bill 1522, which would expand the coverage and affordability of the FAIR Plan. The bill would increase the coverage limit from $1.5 million to $3 million, allow homeowners to purchase comprehensive policies that include other perils besides fire, and cap the annual premium increases at 10%. The bill is also pending in the legislature.

The home insurance crisis in California is expected to worsen before it improves, as wildfires continue to pose a threat to the state. Homeowners are urged to shop around for the best coverage and price, and to take steps to reduce their wildfire risk. Insurers are also encouraged to work with regulators and lawmakers to find sustainable solutions that would stabilize the market and protect consumers.