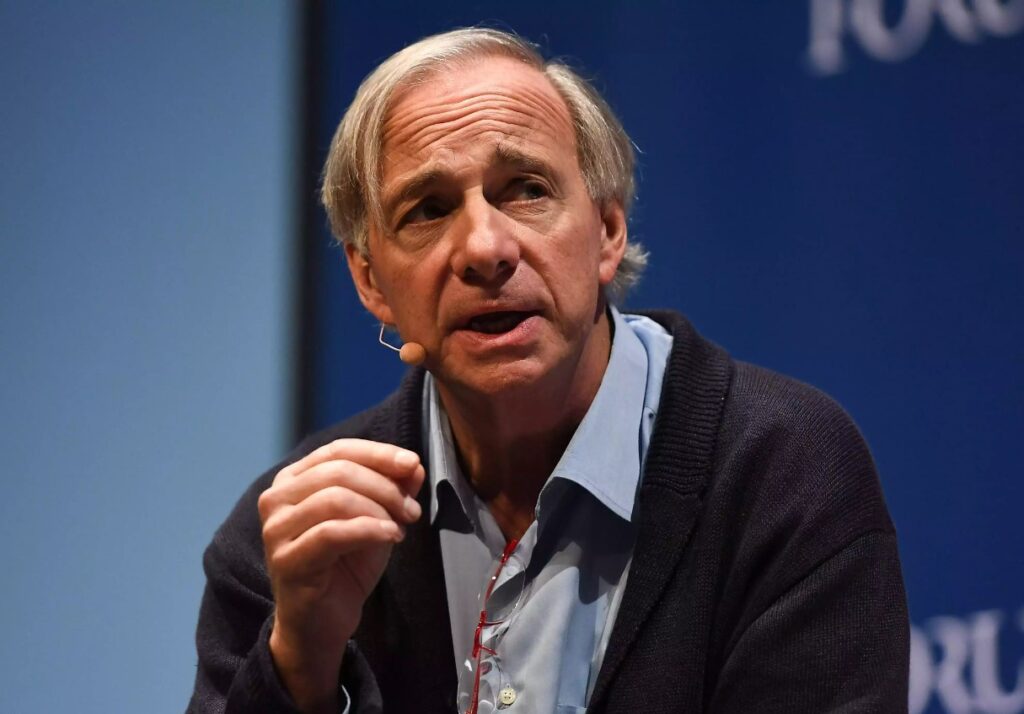

Ray Dalio, the founder of Bridgewater Associates, one of the world’s largest hedge funds, spoke at the Milken Institute Asia Summit in Singapore last week. He shared his views on the changing world order, the implications of artificial intelligence, and the best strategies for new investors.

Dalio warned of “great disruptions” that will transform the world in the next five years, and urged investors to pay attention to the trends and opportunities that will emerge from them. He said that diversification is the key to reducing risk and achieving returns in a volatile environment.

“I would like to have diversification, because what I don’t know is going to be much greater than what I do know,” he said. “Diversification can reduce your risk without reducing them sharply, if you know how to do it well.”

He also said that the biggest mistake investors can make is “believing that markets that performed well, are good investments, rather than more expensive.”

The impact of artificial intelligence on businesses and markets

Dalio also discussed the role of artificial intelligence (AI) in shaping the future of businesses and markets. He said that AI is like a “time warp” that will create a different world, and that the disruptors will be disrupted by new technologies.

He advised investors to invest in companies that adopt AI effectively, rather than those that create it. “I don’t need to pick those who are creating the new technologies. I need to really pick those who are using the new technologies in the best possible way,” he said.

He cited examples of companies that have leveraged AI to gain competitive advantages, such as Amazon, Alibaba, and Tesla. He said that these companies have used data and algorithms to optimize their operations and customer experiences.

The factors to consider when choosing a country for investment

Dalio also shared his criteria for selecting a country for investment. He said that a country needs to have a good income statement and balance sheet, meaning that it has a strong economy and a low debt burden. He also said that a country needs to have an environment of civility, where people work together to make good things happen.

He added that another factor to consider is which side a country takes when international conflicts arise. He said that the world is becoming more polarized and divided, and that investors need to be aware of the geopolitical risks and alliances that may affect their investments.

He praised Singapore as a “very special place” in an “exciting region” that has a good balance of these factors. He said that Singapore is a hub for innovation and trade, and that it has a stable and cooperative political system. He also noted the growing number of family offices being set up in Singapore, which reflects its attractiveness as an investment destination.