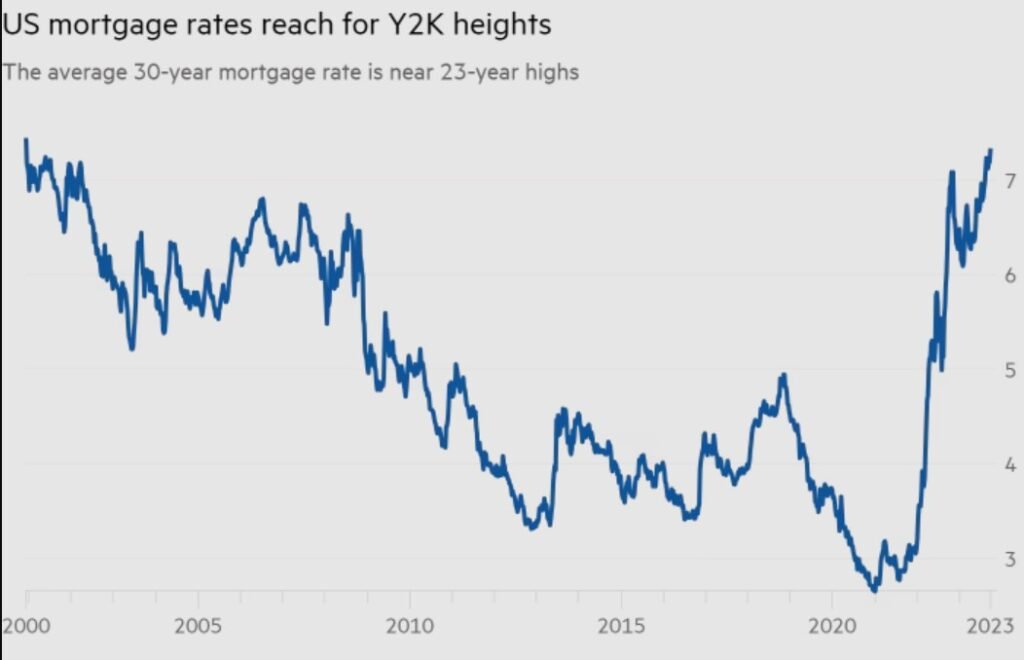

The average rate on the 30-year fixed-rate mortgage in the US has surged to 7.49%, the highest level since December 2000, according to Freddie Mac. The rising cost of borrowing is putting more pressure on homebuyers and homeowners who are already facing a tight housing market and high home prices.

Mortgage rates follow Treasury yields

Mortgage rates are closely tied to the yield on the 10-year Treasury note, which has been rising sharply in recent weeks. The yield reflects the market’s expectations of future inflation and economic growth, as well as the Federal Reserve’s monetary policy.

The Fed has been raising its key interest rate since 2021 to combat rising inflation, which has been fueled by supply chain disruptions, labor shortages, and strong consumer demand. The Fed has also signaled that it may taper its bond-buying program, which has been supporting the financial markets during the pandemic, by the end of this year.

The market is anticipating that the Fed will continue to tighten its policy in 2023 and beyond, as inflation remains above its 2% target. The 10-year Treasury yield has jumped from around 1.5% at the start of this year to over 3% this week, reaching its highest level since 2011.

Home affordability worsens

The increase in mortgage rates has made it more expensive for homebuyers and homeowners to finance their purchases or refinance their existing loans. According to Freddie Mac, the monthly payment on a $300,000 loan at 7.49% is $2,096, compared to $1,231 at 2.99%, which was the average rate in October 2021.

The higher rates have also reduced the pool of potential buyers who can qualify for a mortgage, as lenders tighten their credit standards and income requirements. This has dampened the demand for homes, which were already in short supply due to low inventory and strong demand during the pandemic.

According to the National Association of Realtors, sales of existing homes fell for the fourth straight month in August, down 21% from a year ago. The median home price was $356,700, up 14.9% from a year ago. The inventory of homes for sale was at 2.6 months of supply, well below the six-month level that is considered a balanced market.

Outlook for homebuyers and homeowners

The outlook for homebuyers and homeowners depends largely on how the economy and inflation evolve in the coming months and years. If inflation moderates and growth slows down, as some economists expect, then mortgage rates may stabilize or decline. However, if inflation persists and growth remains strong, then mortgage rates may continue to rise.

For homebuyers who are looking to enter the market, it may be wise to act sooner rather than later, as waiting could mean facing higher rates and prices. However, they should also be prepared to face stiff competition and limited choices in some markets.

For homeowners who are looking to refinance their existing loans, it may be too late to take advantage of the record-low rates that were available last year. However, they may still benefit from refinancing if they can lower their rate by at least half a percentage point or more, or if they can shorten their loan term or switch from an adjustable-rate to a fixed-rate mortgage.